26+ tax deduction on mortgage

12950 for tax year 2022 Married taxpayers who. Single or married filing separately 12550 Married filing jointly or qualifying widow er.

Tax Shield Formula How To Calculate Tax Shield With Example

The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress.

. Taxes Can Be Complex. Web 18 hours agoMarch 10 2023 528 pm. However higher limitations 1 million 500000 if married.

Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web How to Deduct Mortgage Points on Your Taxes.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Standard deduction rates are as follows. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately.

Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million. Web Most homeowners can deduct all of their mortgage interest. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec.

Web Mortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

For tax years before 2018 the interest paid on up to 1 million of acquisition. If you paid mortgage points and youve determined that you qualify for a tax break deducting them is pretty. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web For 2021 tax returns the government has raised the standard deduction to. That cap includes your existing. Single taxpayers and married taxpayers who file separate returns.

EST 2 Min Read. As each half amounts to. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web The mortgage interest deduction is also a popular deduction for homeowners. Web The short answer is.

Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. It all depends on how the property is used.

Web 1 day agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Web Is mortgage interest tax deductible.

Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. The standard deduction for married. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

You can deduct the interest you pay on your mortgage up to a limit of. Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Companies are required by law to send W-2 forms to.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

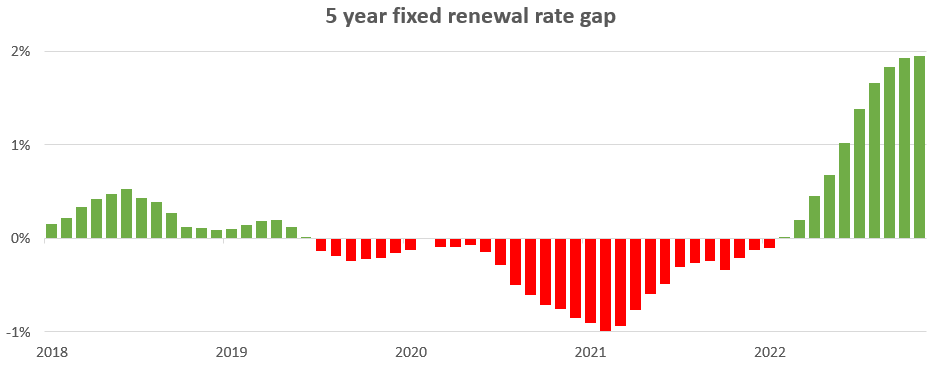

Changing Rates And The Market House Hunt Victoria

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

The Modified Home Mortgage Interest Deduction

American Economic Association

Calculating The Home Mortgage Interest Deduction Hmid

Covid 19 Relief Tracker Small Business And Nonprofits Ry Cpas Ry Cpas

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Tax Credit Vs Tax Deduction What Are They Features Infographics

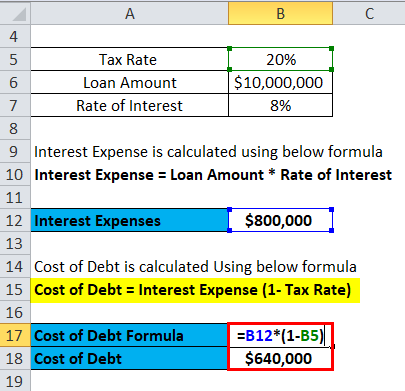

Cost Of Debt Formula How To Calculate It With Examples

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center